Retail Electronic Payments System (REPS)

What is the Retail Electronic Payments System (REPS)?

The Retail Electronic Payments System (REPS) comprises all elements required to support retail payments at a national level. These include enabling legislation and policies, commercial arrangements, member institutions (e.g. banks and other financial institutions) and technical systems and infrastructure. At the core of REPS is a National Switch currently operated by BPNG.

At its launch in July 2019, the National Switch processed local debit card transactions undertaken at EFTPOS terminals and ATMs across different financial institutions. The NPS development programme includes plans to extend REPS to support additional Payment Instruments (for example, retail transfers, credit cards etc) and Acceptance Media, e.g mobile phones. This in turn will support a number of different payment channels expanding Digital Financial Services. Ultimately, how the payments’ landscape develops will be driven by consumer demand.

As noted, at the heart of REPS is the National Switch which moves transaction details between member institutions. If a customer uses an EFTPOS terminal or ATM supplied by their own institution then the transaction is very straight forward; as in this case, the EFTPOS terminal or ATM will send the transaction request to the institution’s system which will either accept or reject the request based on the customer’s account balance. In other words, these transactions are contained within the customer’s institution and do not need to be “switched” across institutions.

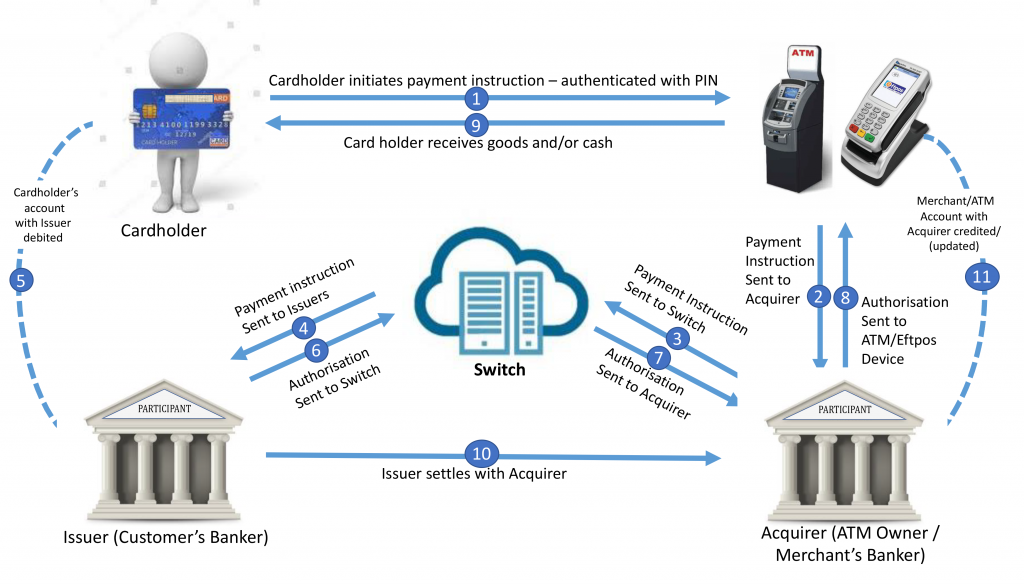

If the EFTPOS or ATM terminal belongs to a different institution then the institution that the device belongs to (referred to as the Acquirer) must contact the customer’s institution (referred to as the Issuer) for authorisation. This is facilitated by the switch which automatically routes payment messages over a secure network between the two institutions (both the authorisation request to the customer’s institution and the subsequent response back from the customer’s institution).

Depiction of an Card Payment involving two Different Financial Institutions

The National Switch enables card holders to use any REPS member’s EFTPOS terminal or ATM irrespective of the financial institution they belong to, anytime, anywhere in PNG. This is referred to as “interoperability”.

Interoperability means that not only is this convenient for customers, but it also has other benefits:

Firstly, it saves financial institutions from having to enter into one-on-one agreements with each other in order for their customers to use each other’s EFTPOS terminals and ATMs. It is also more economic for financial institutions because instead of needing to pay for the purchase and maintenance of their own technology they will benefit from the economies of scale afforded by a single National Switch as reflected in the switching fees charged by BPNG.

Second and importantly, it enables smaller institutions to participate directly in providing card and electronic payment services as REPS provides a solution that is financially viable and readily accessible for them to use. Prior to the introduction of REPS the smaller institutions were compelled to operate through commercial banks. Making the provision of these services available to smaller participants directly through REPS not only serves to create a level playing field for all participants but also increases competition which ultimately results in lower transaction fees to customers. It will also provide greater convenience to customers as ATMs and EFTPOS become increasingly available.

Mobile money and mobile payments are increasingly being used to make financial services more accessible and affordable. Work is underway to introduce more mobile and digital payment options and interoperability for mobile providers who offer mobile wallets and payments. Options for both feature phones and rural areas with limited internet access are being developed alongside consideration of the latest digital alternatives available with smartphones.

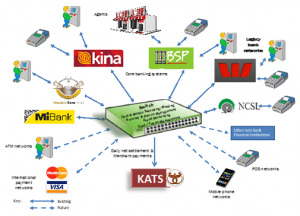

REPS enables a wide range of Financial Institutions and Payment Services Providers (PSPs) to offer Payment Services

Current REPS Participants

There are currently six REPS members:

- BSP

- Kina Bank

- Nasfund Contributors Savings and Loan Society (NCSL)

- People’s Micro Bank Limited (PMBL)

- MiBank (Nationwide Microbank)

- Westpac

Further members will join when their systems and processes enable them to do so.