Retail Electronic Payments System (REPS) Monthly Statistics Updates

NATIONAL SWITCH STATISTICS

The Payment Systems Department runs two mission critical systems for the continued operation of business and consumers in PNG, with the support of other departments of the bank. The two systems are Kina Automated Transfer System (KATS) and Retail Electronic Payment System (REPS), which is operated by a dedicated group of employees who ensures their smooth operations. The inability of the payment systems, either KATS & REPS to process payments effectively and efficiently could disrupt nationwide economic activity.

What does REPS Process?

REPS processes card-based transactions using ATMs and EFTPOS terminals. The six members of REPS include commercial banks, Micro Banks, Savings and Loan organizations. They are BSP, Westpac, Kina Bank, NCSL, MiBank and PMBL. Any ATM or EFTPOS terminal offered by a REPS Member is open to the local debit cards offered by any other Member. This means a card issued by any of these Members can be used at other REPS Member devices making in-store payments easy and access to cash available at virtually all ATMs and EFTPOS counters in PNG.

REPS also processes Instant Payment Transactions (IPT). IPT was launched in March 2021. These are a real time digital payment currently offered by the non-bank REPS members – NCSL, MiBank and PMBL. IPT volumes remain low as expected until the Commercial Banks offer them. Refer to table 1. Commercial banks will be added when they have the necessary system capabilities.

REPS is a 24/7 system. It operates 24 hours a day, 7 days a week – every day of the year. If people need to make a card-based payment on the weekend or after business hours REPS processes the transaction. An important transaction offered by REPS (and local debit cards) is the EFTPOS Purchase + Cashback. This allows people to make a card payment at a shop and get cash at the same time.

When did REPS Go-Live?

The Retail Electronic Payments System (REPS), with the National Switch at its core, commenced operation in 21 July 2019, with three inaugural members, namely BSP, Kina Bank and NCSL and three more institutions joined on 1st of September. They were Westpac Bank, PMBL and MiBank. This brings the total of six (6) financial institutions connected to National Switch. Another important development during the period was the acquisition of ANZ Bank Retail Customers by Kina Bank on the 23rd September, which resulted to significant increase in volumes processed by the National Switch.

After the launch in July 2019, REPS continued to deliver improved access with minimal disruptions and processed over 71.5 million transactions (excluding balance enquiries), valued at K12.6 billion at the end of February 2024.

Ongoing Developments

Planning for Retail Electronic Payments System (REPS) Phase 2 has begun simultaneously with the review of the National Payments System Strategy (NPSS) 2024-2026. A consultant was engaged to review the NPSS and the Draft Report was completed in January 2024. Some of the findings from the NPSS review included: the need to re-scope REPS Phase 2 with more definitive delivery targets, pursue for BPNG to be compliant to Payment Card Industry Data Security Standard (PCIDSS) for the long-term viability of REPS card transactions, since commercial banks are moving away to international scheme cards to mitigate fraud and recommendation to have two separate systems for IPT & Cards. Two more consultants will be co-funded by the Bank of PNG and Australia PNG Economic Partnership program (APEP) to complete the project. Under REPS Phase 2, work will extend to connection to other small Financial Institutions and Payments Service Providers through additional infrastructure, commercial arrangements and operational procedures. The focus of this phase will be on digital and mobile payments that will offer a wider range of payment services and to promote the objective of financial inclusion.

Automation of disputes processing will be available in second quarter of 2024 and work is underway to add more Licensed Financial Institutions as members using Instant Payments to provide real-time digital payments any time of the day including nights and weekends.

Refer to REPS Statistics and Charts below.

Statistics from all Participating Institutions[1]

(BSP, Kina, NCSL, WPC, MiBank & PMBL)

Total Values and Volumes Processed by National Switch

Table 1. REPS Summary Statistics

| Total Transaction Volumes | IPT Values | |||

| Period |

Domestic Debit Cards |

Instant Payment Transactions (IPT) |

Total (PGK) |

Average Transaction Value (PGK) |

| 2019[2] | 4,336,050 | N/A | N/A | N/A

|

| 2020 | 13,825,844 | N/A | N/A | N/A

|

| 2021[3] | 18,118,532 | 211 | 84,751 | 402

|

| 2022 | 25,937,214 | 779 | 358,372 | 460

|

| 2023 | 28,611,453 | 563 | 201,896 | 359

|

| 2024[4]

|

7,141,294 | 237 | 107,749 | 455 |

| January | 2,330,321 | 69 | 35,107 | 509

|

| February

|

2,371,821 | 93 | 39,310 | 423 |

| March

|

2,439,152 | 75 | 33,332 | 444 |

[1] Table 1 statistics “Excludes” transactions between Kina Bank and MiBank. Refer Table 3.

[2] On 21st July 2019, National Switch went live with BSP, Kina Bank and NCSL. The other three (3) new members, namely Westpac, PMBL and MiBank were connected on 01st September 2019.

[3] On 28th March 2021, Instant Payments Transactions (IPT’s) went live.

[4] The 2024 figures are till March . The volumes of IPT are gradually increasing due to reconnection of NCSL to REPS on the 18th August, after it was disconnected in March 2023, resulting from ransomware attack.

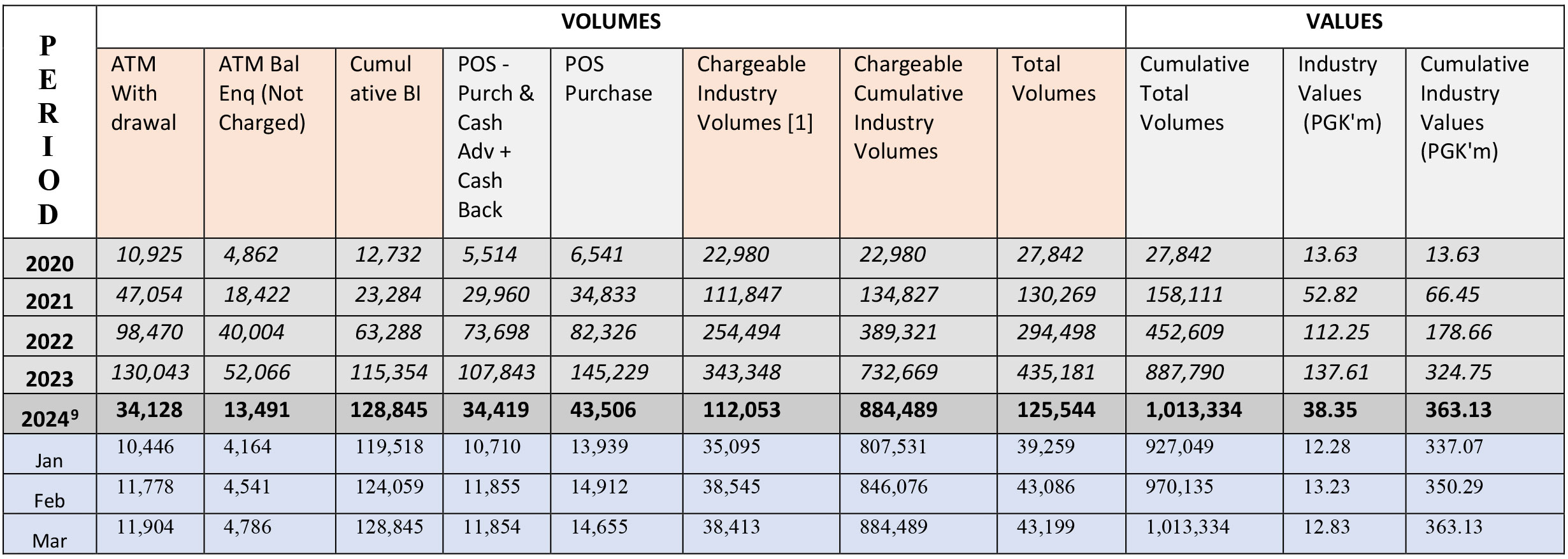

Table 2. Debit Card Statistics

[5] Sum of “Withdrawals, Purchase and Cash Advance and Purchase only”, Excluding the “Balance Enquiry”

[6] On 21st July, National Switch Went-Live with BSP, Kina Bank and NCSL. On the 01st of September 2019, three additional institutions, Westpac, PMBL & MiBank joined the National Switch and following on 22nd September Kina Bank acquired the Retail business from ANZ Bank. This resulted to substantial increase in the volumes of transactions switched via the National Switch.

[7] Beginning year 2022 – POS BI was part of ATM BI calculations effective 29 Mar 21 to 31 Dec 21. It was then captured as separate item column effective 01Jan22 under POS BI. The statistics also reveals that most cardholders use POS to check their balances instead of ATM’s.

[8] March 2024 – the National Switch processed over K12.9b. The volumes processed during the same period was over 73.2 million (chargeable) & 24.7 million (non-chargeable) transactions.

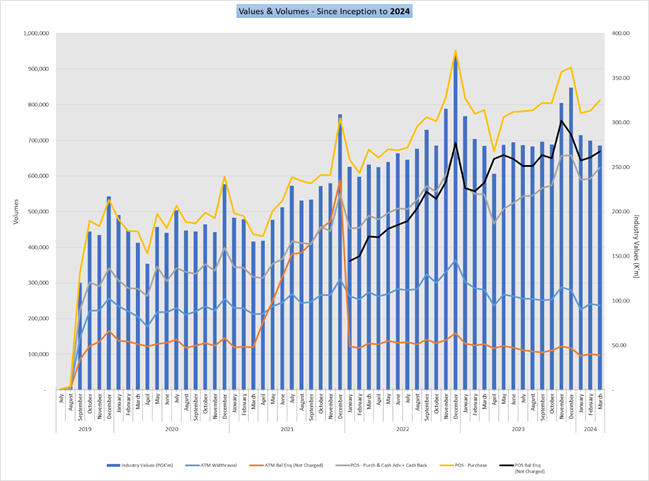

Chart 1. REPS Charts from all participating Institutions

This chart indicates the monthly volumes by type of cards used for payment and aggregate values in K’ millions.

NB: Monthly industry values (K’ millions) shown in this chart, when added together month by month since go-live in July 2019, will equate to the cumulative values (K’ millions) shown in the statistics table on the previous page.

In April 2021 REPS introduced the Point of Sale- Balance Inquiry (POI-BI) transaction. The figures above for ATM Bal Inquiry include the POS BI volumes from April 2021 onwards. As this transaction has no fees it has been popular with end-customers and its impact can be seen from May onwards.

Volumes were particularly high in the December festive season and have returned to normal trend in January. Note as well that POS BI was effectively separated from ATM Bal Inquiry and captured as a separate line item effective Jan-2022.

Note: The black trend-line on the graph shows POS Balance enquiry (Not chargeable) segregated and reported separately beginning in January 2022 – Refer to Table-2. April 2023 indicates a spike in the POS BI transactions due to upgrade of BSP’s Core Banking Services early April that affected BSP customer’s mobile banking and Internet banking services.

MiBank Transactions with Kina Bank

In August 2020 Kina Bank and MiBank commenced a business arrangement relating to card transactions for the MiBank customers to be routed via Kina Bank. The arrangement means:

- REPS sends all MiBank card transactions to Kina Bank, who in turn sends them to MiBank;

- When MiBank customers use Kina Bank terminals they are routed directly to MiBank and they are not sent to REPS.

As a part of this arrangement MiBank, as the card Issuer, has agreed to have the transactions performed on Kina Bank terminals charged by BPNG in the same way as if they were processed using REPS.

These transaction volumes are reported to BPNG every day. Table 3 contains these statistics. These transactions are in addition to the volumes shown in Tables 1 & 2.

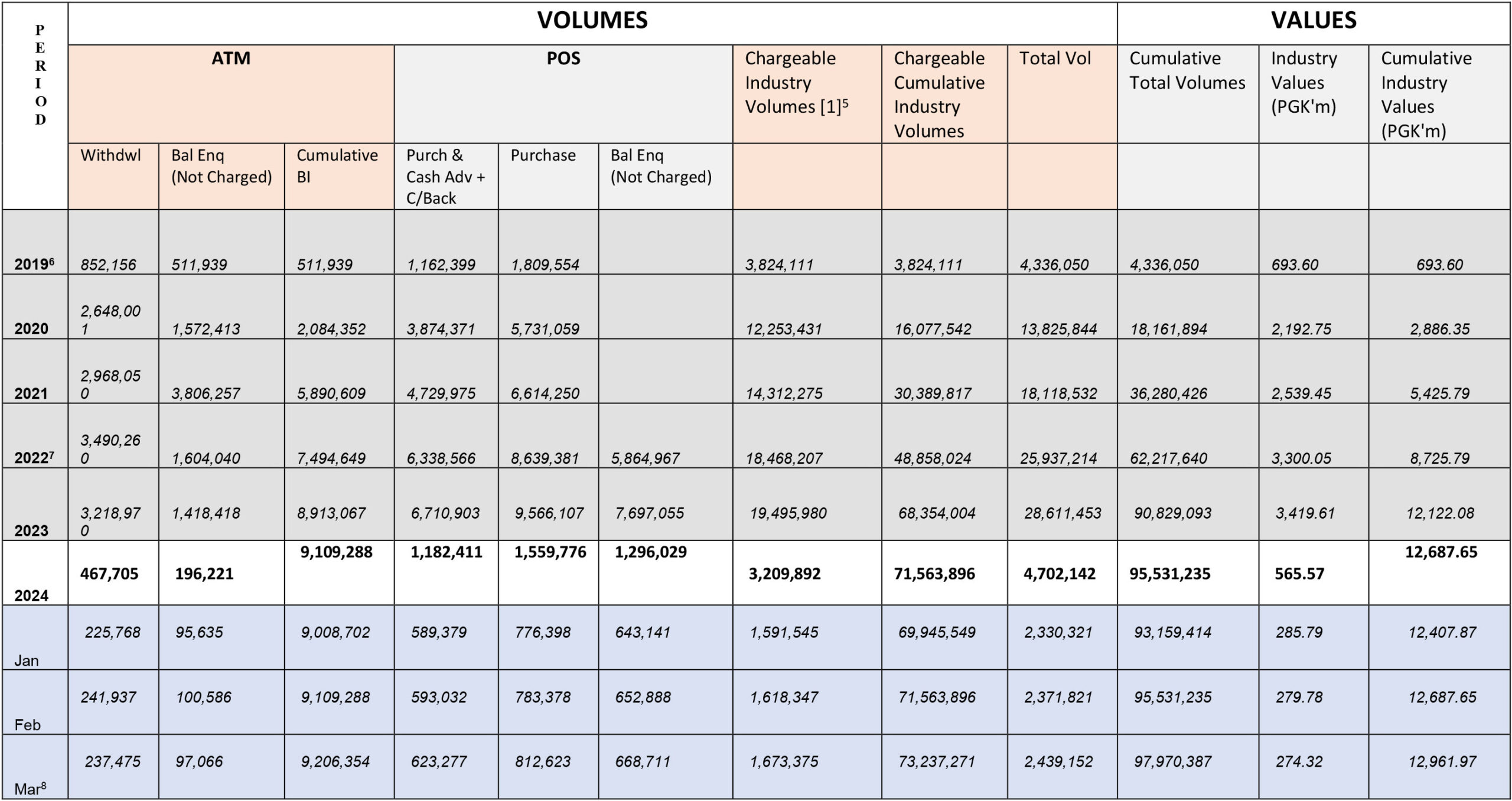

Table 3. Statistics from MiBank & Kina Bank

Total Values and Volumes Processed by National Switch

[9] The 2024 statistics only shows the accumulated totals to March 2024.

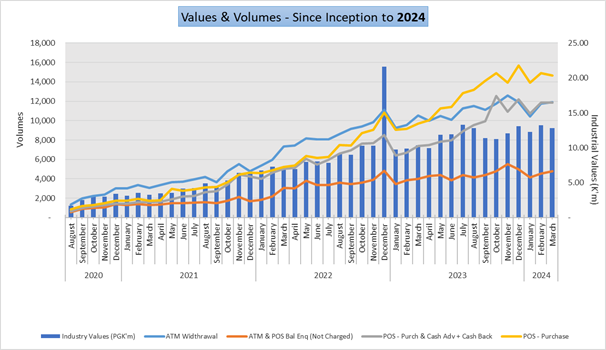

Chart 2. REPS Charts on transaction between MiBank and Kina Bank.

This chart indicates the monthly volumes by type of cards used for payment and aggregate values in K’ millions for MiBank & KINA.

NB: December 2022 monthly industry values (K’ millions) shown on chart 2 reflects an increase in value due to festive spending by MiBank customers. In 2024, industry values returned to normal pattern. Transaction volumes for March are slightly lower than February.

Payment Systems Department

15th April 2024