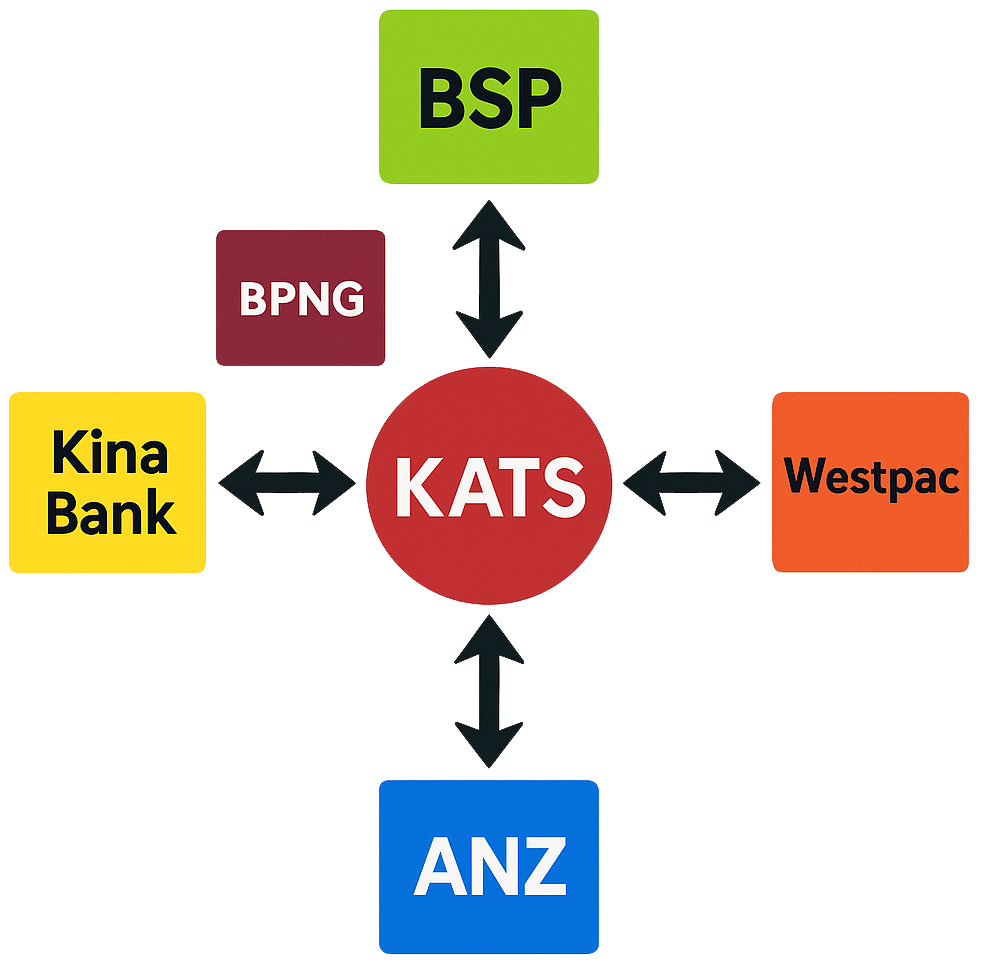

The Kina Automated Transfer System (KATS) is used by the commercial banks to transfer money between themselves or the Bank of Papua New Guinea (BPNG). Other non-bank financial institutions such as Savings and Loan Societies and Microbanks are not directly connected to KATS but they all bank with a commercial bank, and like any commercial bank customer, utilise KATS indirectly.

The relationship of the banks to KATS is illustrated in the following diagram.

All commercial banks are Participants in KATS as is BPNG

(both as a Participant and as the Operator)

There are three types of payments supported by KATS:

- Real Time Gross Settlement (RTGS)

- Direct Credits

- Cheque processing.

The main advantage of KATS is that it offers different ways to pay so that payments are not restricted to cash and cheques only, as was the case prior to its introduction. RTGS and Direct Credits are electronic payments that are faster, safer and more efficient than cheques. Cheque volumes are decreasing as more customers (both individuals and institutions) move to electronic payments, although their use remains significant (see KATS Statistics). People still find cash convenient for small payments, although in many countries there is a growing trend away from cash, particularly amongst the younger generation.

Real Time Gross Settlement

As noted, prior to the introduction of KATS the only way to make payments was by way of cash or cheques. With the introduction of KATS two forms of electronic payments are now available.

Real Time Gross Settlement payments, which are available through the commercial banks, are typically used for high value and/or high priority payments. Instead of writing a cheque and giving it to a payee (the recipient of the payment), the payer instructs their bank to make a RTGS payment on their behalf using funds available in their bank account. Each RTGS payment is settled instantaneously once it has been input into KATS.

Once an RTGS payment is complete the payment is irrevocable which means that it can be neither dishonoured nor reversed. The KATS rules require that the payment must be credited to the payee’s account within two hours of the payee’s bank receiving it.

Automated Clearing House (ACH)

KATS provides for clearance and settlement of cheque and direct credit payments four times per day from Monday to Friday. The first bulk clearing is from 9:00 – 9:30, second from 11:30 – 12.00, third from 2.00 – 2.30 and the last from 4:00 – 4:30. Any payments submitted to KATS before the commencement of the clearing session are settled at the end of that session.

Previous to KATS, BPNG acted as the Cheque Clearing House whereby cheques were transported to a physical location and exchanged, and processed, manually.

The net settlement process involves KATS storing the Direct Credit and Cheque transactions until the next clearing session at which time KATS determines each bank’s net position in respect of the other banks (including BPNG). KATS then transfers funds so that each bank either receives or pays a single amount equalling their combined net position with each of the other banks and forwards the Direct Credits and Cheques to the receiving banks to be credited to the corresponding payees’ accounts.

Direct Credits

Direct Credits are similar to RTGS payments but instead of being settled immediately on an individual basis, they are settled between the banks in batches on a net basis four times a day.

Direct Credits are typically used for high volume, lower value payments such as company or government payrolls. Payments made by individuals using internet banking will typically be sent as Direct Credits.

The majority of Direct Credits are settled on the day they are initiated with exceptions being those initiated late in the day which will be settled on the morning of the next business day.

Despite the respective attributes of RTGS and Direct Credit payments and their intended usage there is currently no minimum nor maximum value set for these two types of transactions. However, RTGS transactions attract higher fees than Direct Credits making RTGS relatively uneconomic for low value, non-urgent transactions.

Cheque Processing

KATS supports “cheque truncation” whereby cheques are typically scanned at the bank branch where they are deposited. The scanning process captures the image of the front and back of the cheque and records the cheque details that are imprinted in magnetic ink on the bottom of the cheque. This enables faster processing and reduces opportunities for fraud. Any information that the scanner is unable to capture is inputted manually into KATS typically at the time it is deposited.

The cheque information captured by KATS is processed at BPNG four times per day alongside Direct Credits and delivered electronically to the payer’s bank to be cleared (or dishonoured as the case might be). A decision on whether a cheque is cleared or not now takes two days rather than around four to nine days that it used to take before the introduction of KATS.