Government Treasury Bills

Treasury Bills (Tbills) is a financial debt instrument issued by the Bank on behalf of the Government to raise funds in order to finance budget deficits. A budget deficit is when Government expenditure is higher than revenue.

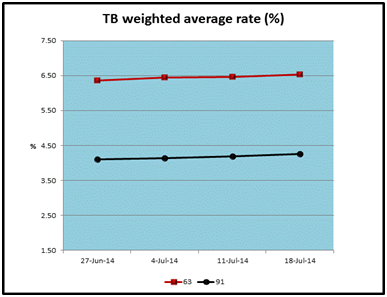

Tbills is a short-term discounted paper with fixed maturities of 28, 63, 91, 182 and 364 days, redeemable at par on maturity. The Government has the discretion to set the amount to be issued/sold together with the terms/maturities. Currently, only the 182-day and 364-day terms are issued.

The General Public can invest in Tbills by purchasing through an auction which is conducted every Wednesday (weekly) from 9am – 11am, at the Bank of PNG.

Investors outside of Port Moresby can also purchase or invest in Treasury Bills. Rates or yields are determined by investors themselves through bidding.

NOTE: Government Departments and Agencies are not allowed to invest in TBills, CBBs and Inscribed Stock.

For more information, click on the following links or contact the Bank’s investment team on [email protected].

- TBills Weekly Auction Announcement

- Bills Weekly Auction Results

- Tbills Bid Form

- Investor ID Form

- Tbills Information Brochure

- TBills Terms and Conditions

- TBills Historical Results

- TBills investment calculator