Media released by Acting Governor Ms Elizabeth Genia on Digizen Digital Bank ID graduates from the Regulatory Sandbox – the first Digital ID approved for Customer Due Diligence

Digizen Digital Bank ID graduates from the Regulatory Sandbox – the first Digital ID approved for Customer Due Diligence

Date: 12 June 2023

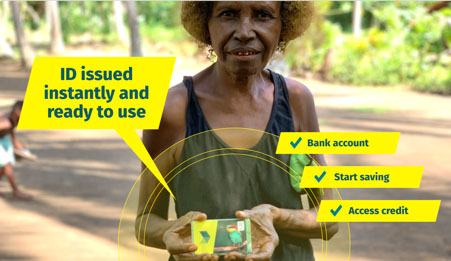

Port Moresby – The Bank of Papua New Guinea (BPNG), the country’s Central Bank and Financial Regulator, is pleased to announce the graduation of Digizen’s Digital Bank ID from the Regulatory Sandbox to commercial deployment. This milestone achievement highlights the value of the Regulatory Sandbox in creating new social and economic opportunities, as Digizen’s Digital Bank ID becomes the first approved solution for verifying identity details in Customer Due Diligence.

During testing in the Sandbox, Digizen’s Digital Bank ID successfully established unique biometric identities for 2,500 individuals, instantly issuing Digital Bank ID cards that were used to open bank accounts and access banking services. This transformational technology removed a significant barrier for rural villagers, providing them with identification in minutes, a process that previously took months. This advancement prepares them for future financial needs and aspirations.

“We are proud of the Sandbox process fostering innovation like the Digital Bank ID, which is interoperable between banks and specifically designed to meet our nation’s unique needs. Easy access to secure identification is key to driving financial inclusion among our people,” said Ms Elizabeth Genia, Acting Governor of the Bank of Papua New Guinea.

BPNG has thoroughly assessed Digizen’s Digital Bank ID through the Regulatory Sandbox and is satisfied that all requirements, agreed key performance indicators, and risks were adequately managed during the testing period.

“With the approval of BPNG, which attests to the robustness and security of the Digital Bank ID solution, we can now proceed with our commitment to commercialise this technology in the country,” said Mr Kimmo Koivisto, CEO of Digizen.

The Sandbox testing of the Digital Bank ID was conducted in partnership with an international development partner, the Asian Development Bank, as well as financial institutions MiBank and Women’s Microbank. Digizen, an IT company from Finland, developed and operates the Digital Bank ID system.

Asian Development Bank

ADB as an international development partner committed to achieving a prosperous, inclusive, resilient, and sustainable Asia and the Pacific, while sustaining its efforts to eradicate extreme poverty. ADB provided financial support and knowledge and technical expertise as needed. It was also a neutral dialogue partner, contributing to open and constructive communication.

The Bank of Papua New Guinea

The central bank of Papua New Guinea serves the people of Papua New Guinea by conducting effective monetary policy and maintaining a sound financial system. BPNG acted as the data governor, setting the rules, standards, policies and overseeing their enforcement by all participating entities.

MiBank and Women’s Micro Bank (Mama Bank)

MiBank and Mama Bank are banks, who registered cardholders to the Digital Bank ID Card scheme. They issued cards, following standard rules and policies set by BPNG. The banks used the Digital Bank ID cards to identify their customers for bank transactions such as account openings, cash deposits and withdrawals.

Digizen

Digizen is a Finnish IT company and the developer of the Digital Bank ID Card system. Digizen set up, managed the operations of the entire system, and provided technical support for the financial institutions.

Authorised by: Elizabeth Genia, AAICD

Acting Governor