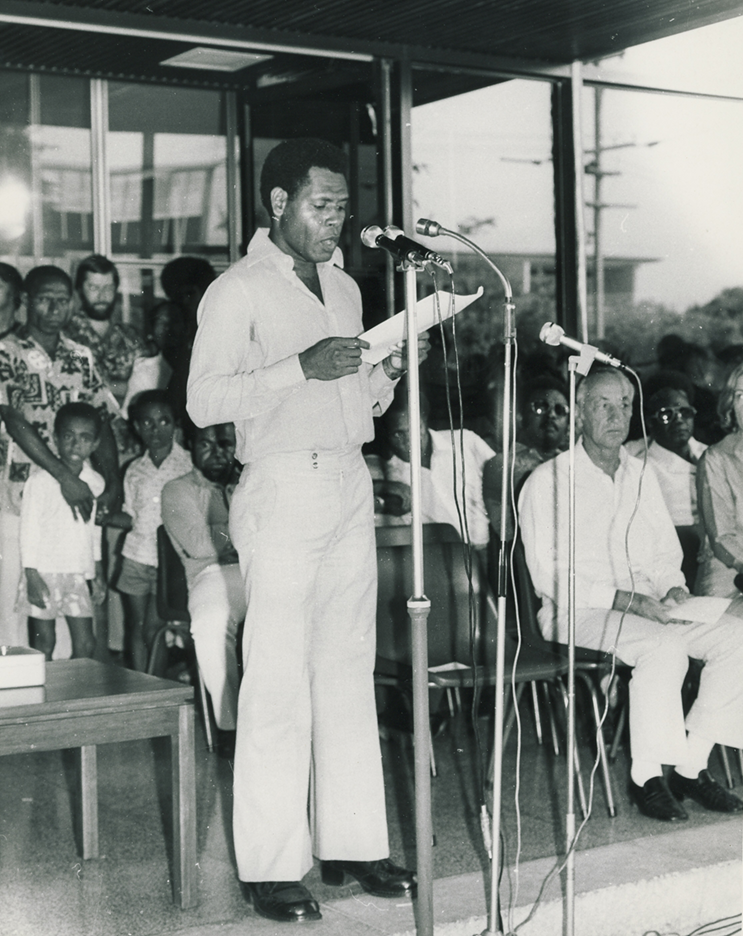

Governor Bakani’s Tribute to Late Sir Henry ToRobert

The passing of Sir Henry ToRobert on Thursday October 18, 2018 marked the end of an era – of someone in that generation who participated in nation-building at the time of independence. That distinction falls on a select few who get that rare once-only opportunity to help set up institutions during the birth of a nation. Sir Henry was fortunate to be in the right place at the right time. But good fortune alone does not fully explain everything – for Sir Henry was one of a kind. He was a leader, mentor, trailbrazer and stout disciplinarian, who went on to fulfil his destiny as the founding Governor of the Bank of Papua New Guinea. .

It perhaps came as no surprise that a young man from the progressive Tolai tribe of the East New Britain province (district as the case was before independence) would be recognized very early on for his talents and leadership skills. This led to his selection and grooming by the Reserve Bank of Australia (RBA), together with other young Papua New Guineans, in preparation for a future central bank of PNG when independence came. Setting up a central bank to independently manage the monetary and financial affairs of a country were considered important steps towards PNG gaining nation-hood.

Along the way, Sir Henry achieved many firsts. They are too numerous to mention but the notable ones include: establishment of the Bank of PNG as the country’s central bank in November 1973, two years before PNG attained independence; overseeing the introduction of the country’s new currency, kina and toea, in April 1975 and subsequent withdrawal of the Australian currency; attaining membership to the International Monetary Fund in October 1975; managing the country’s ‘hard kina policy’ following independence with the fixed exchange rate regime; opening of the new BPNG ‘ToRobert Haus’ in 1990; and the start of a change in banknote material with the introduction of the polymer (plastic) 2 Kina banknote in 1991. PNG was the third country after Australia and New Zealand to have polymer banknotes.

Sir Henry through the process of localizing the Deputy Governor position with capable nationals in the likes of Nick Bokas and Wilson Kamit (later Sir Wilson) by the time he left office. Localization with competent nationals was one of his hallmarks. At the time of his departure in 1993, most other senior positions in the Bank were held by nationals. Out of 231 staff in that year, only 5 were expatriates who were mainly consultants on long-term TA arrangements, compared to 12 expatriate staff out of 121 staff in 1973. By then, BPNG was a fully-fledged central bank run by competent nationals, an envy of many other Government agencies and international observers.

During his long and illustrious career as Governor, Sir Henry oversaw the growth of the central bank and the financial system of the country. Before and following independence, the branches of foreign own financial  institutions were taken over or locally incorporated in PNG. For those of us old enough to remember, such household names like the Commonwealth Bank of Australia and the National Australia Bank were acquired by PNGBC and incorporated as Bank of South Pacific, respectively. Bank of New South Wales (later to become Westpac) and ANZ were locally incorporated. In later years, he oversaw the entry and departure of other banks, including Niugini-Lloyds International and Indosuez Niugini.

institutions were taken over or locally incorporated in PNG. For those of us old enough to remember, such household names like the Commonwealth Bank of Australia and the National Australia Bank were acquired by PNGBC and incorporated as Bank of South Pacific, respectively. Bank of New South Wales (later to become Westpac) and ANZ were locally incorporated. In later years, he oversaw the entry and departure of other banks, including Niugini-Lloyds International and Indosuez Niugini.

Sir Henry management style was what one would call from the ‘old school’. This was perhaps a product of the times following the transition from colonial rule to independence. It was nonetheless effective and perhaps, necessary in those formative years. With a hierarchical organizational structure, he kept a keen eye on the running of the institution. He enforced strict discipline, order and adherence to rules. Many staff feared his wrath when stepping out of line. He is famously known for dialing up a manager’s phone and hanging up when answered – just to make sure the manager was at work.

Looking back now, Sir Henry’s role in building up the central bank appears to be one of no mean feat. It has to be emphasized that he enforced central bank independence without legislative backing that came much later with the revamped Central Banking Act of 2000. He ensured good governance, strong work ethics and exemplary staff conduct long before those became catch-phrases in management circles. He worked towards building up staff capacity and training, fostering links with key institutions including the universities, the IMF training Institute, other central banks, the South East Asia Central Banks (SEACEN) training centre and South East Asia New Zealand Australia (SEANZA) program. He encouraged a good working relationship with the Government Departments, especially Finance and Treasury Departments. He was visionary and had the foresight to recognize short-comings and the courage to request professional technical assistance from the IMF and reserve banks in the region where necessary to build up internal capacity. For example, he engaged Tom Nordman in financial markets, Silan Nadarajah in Accounting, and Late Dr. Jakob Weiss in economics and banking supervision. All those consultants have left their mark on the Bank of PNG.

Bank of PNG now enjoys the fruits of Sir Henry’s foundations for a central bank. These include: a proper functioning central bank adequately staffed; sound financial system with a good oversight and supervisory role by BPNG; and of course the modern ToRobert Haus, named after him, that houses the Bank.

Sir Henry’s professional work as a Central Banker and Governor was well-known in PNG and around the world. He was well respected. Following the announcement of his retirement, the telex printer in the communications unit of the central bank ran hot – printing out pile after pile of scripts containing well wishes and congratulatory messages from friends and colleagues around the country and the globe. That time the advent of internet, mobile phone and email technology have yet to have an impact in PNG. Telex was then the common mode of communication.

Late Sir Henry embodied the characteristics of the ultimate civil servant and a true gentleman. Towards the end of his term as Governor, when asked for the reasons of his replacement and comments on his successor, he courteously declined to comment, saying that anything he said would be misconstrued by the media. He chose silence rather than create a controversy. That showed the true character of the man who left the office he served for so long without any remorse, regrets or malice. He walked away from the institution he built up with his head held high and his integrity intact. A true servant of the people.

Sir Henry had survived three other central bank governors before his passing – late Koiari Tarata, John Vulupindi and Morea Vele. At this time when we search for such people of caliber and integrity who serve in positions of trust and high office, it serves us well to recall late Sir Henry’s contributions to BPNG and PNG. His legacy will endure long after his passing with the strong and credible institution the Bank of PNG is now and in the staff who have served under him and currently hold middle and senior management positions in the central bank – a true testimony to Sir Henry’s commitment, efforts and vision as the founding Governor of the Bank of PNG.

Sir Henry had survived three other central bank governors before his passing – late Koiari Tarata, John Vulupindi and Morea Vele. At this time when we search for such people of caliber and integrity who serve in positions of trust and high office, it serves us well to recall late Sir Henry’s contributions to BPNG and PNG. His legacy will endure long after his passing with the strong and credible institution the Bank of PNG is now and in the staff who have served under him and currently hold middle and senior management positions in the central bank – a true testimony to Sir Henry’s commitment, efforts and vision as the founding Governor of the Bank of PNG.

Thank you Sir Henry for the legacy you have left behind. Farewell Sir Henry and rest in eternal peace.

Kina exchange rate (MIDRATE)

Released:19/04/2024